Those who follow my articles know that trying to predict gold prices has become an obsession for me these days. And I am also wondering which factors affect the prices. For the gold prices per gram in Turkey, are told that two factors determine the results: USA prices per ounce and exchange rate for theContinue reading “Time Series Forecasting with XGBoost and Feature Importance”

Author Archives: Selcuk Disci

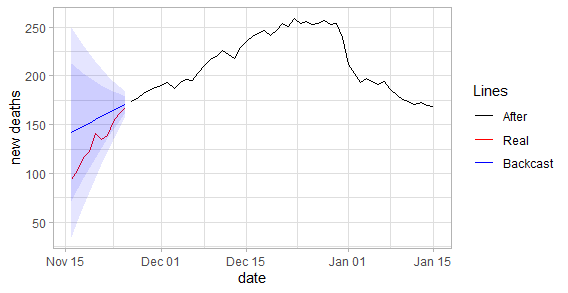

Backcast a Time Series for COVID-19 Truths

A couple of months ago, Turkey’s Health Minister announced that the positive cases showing no signs of illness were not included in the statistics. This statement made an earthquake effect in Turkey, and unfortunately, the articles about covid-19 I have wrote before came to nothing. The reason for this statement was the pressure of theContinue reading “Backcast a Time Series for COVID-19 Truths”

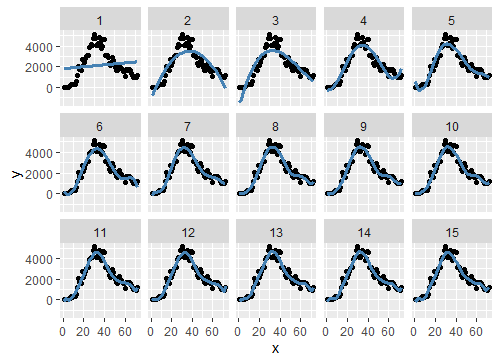

Bootstrapping Time Series for Gold Rush

Bootstrap aggregating (bagging), is a very useful averaging method to improve accuracy and avoids overfitting, in modeling the time series. It also helps stability so that we don’t have to do Box-Cox transformation to the data. Modeling time series data is difficult because the data are autocorrelated. In this case, moving block bootstrap (MBB) shouldContinue reading “Bootstrapping Time Series for Gold Rush”

Approaches to Time Series Data with Weak Seasonality: Dynamic Harmonic Regression

In the previous article, we have tried to model the gold price in Turkey per gram. We will continue to do that to find the best fit for our data. When we chose the KNN and Arima model, we saw the traditional Arima model was much better than the KNN, which is a machine learningContinue reading “Approaches to Time Series Data with Weak Seasonality: Dynamic Harmonic Regression”

Time Series Forecasting: KNN vs. ARIMA

It is always hard to find a proper model to forecast time series data. One of the reasons is that models that use time-series data often expose to serial correlation. In this article, we will compare k nearest neighbor (KNN) regression which is a supervised machine learning method, with a more classical and stochastic process,Continue reading “Time Series Forecasting: KNN vs. ARIMA”

Model Selection: Adjusted Coefficient of Determination-Variance Tradeoff

WARNING: IN THE INTERVIEW AT 25/11/2020, THE MINISTER OF HEALTH OF THE REPUBLIC OF TURKEY CONFESSED THAT THE PEOPLE WHOSE TESTS(COVID-19) WERE POSITIVE BUT DID NOT SHOW THE SYMPTOMS, HAD NOT BEEN INCLUDED IN THE DAILY NEW CASES NUMBERS UNTIL NOW; IN THIS CASE THE DATASOURCE WE USED FOR TURKEY IS MISLEADING. I APOLOGIZE FORContinue reading “Model Selection: Adjusted Coefficient of Determination-Variance Tradeoff”

Turkey vs. Germany: COVID-19

WARNING: IN THE INTERVIEW AT 25/11/2020, THE MINISTER OF HEALTH OF THE REPUBLIC OF TURKEY CONFESSED THAT THE PEOPLE WHOSE TESTS(COVID-19) WERE POSITIVE BUT DID NOT SHOW THE SYMPTOMS, HAD NOT BEEN INCLUDED IN THE DAILY NEW CASES NUMBERS UNTIL NOW; IN THIS CASE THE DATASOURCE WE USED FOR TURKEY IS MISLEADING. I APOLOGIZE FORContinue reading “Turkey vs. Germany: COVID-19”

Testing the Correlation between Time Series Variables

In the previous article, we examined trends and seasonality in gasoline prices in Turkey. This time we will examine whether the gasoline prices are related to the variables that are thought to affect gasoline prices the most by the Turkish people. One of the variables is the Brent crude oil prices that are averaged monthlyContinue reading “Testing the Correlation between Time Series Variables”

Trend Forecasting Models and Seasonality with Time Series

Gasoline prices always is an issue in Turkey; because Turkish people love to drive where they would go but they complain about the prices anyway. I wanted to start digging for the last seven years’ prices and how they went. I have used unleaded gasoline 95 octane prices from Petrol Ofisi which is a fuelContinue reading “Trend Forecasting Models and Seasonality with Time Series”