Silver, Nasdaq Blockchain Economy Index, Bitcoin, and iShares Semiconductor ETF are always thought of as correlated with each other by investors.

We will test this perception with the corrr package.

#iShares Semiconductor ETF (SOXX)

df_soxx <-

tq_get(x = "SOXX") %>%

select(date, soxx = close)

#Silver Futures

df_silver <-

tq_get("SI=F") %>%

select(date, silver = close)

#Nasdaq Blockchain Economy Index

df_nasdaq_blockchain <-

openxlsx::read.xlsx("https://github.com/mesdi/investingcom/raw/refs/heads/main/nasdaq_blockchain.xlsx",

sheet = "History",

detectDates = TRUE) %>%

as_tibble() %>%

janitor::clean_names() %>%

select(date = trade_date, blcn = index_value)

#Bitcoin

df_btc <-

tq_get("BTC-USD") %>%

select(date, btc = close)

#Merging the datasets

df_merged <-

df_silver %>%

left_join(df_soxx) %>%

left_join(df_nasdaq_blockchain) %>%

left_join(df_btc) %>%

drop_na() %>%

filter(date >= last(date) - months(36))

#Correlation

d <- correlate(df_merged, quiet = TRUE)

d %>%

focus(silver:btc, mirror = TRUE) %>%

fashion()

# term silver soxx blcn btc

#1 silver .78 .89 .89

#2 soxx .78 .85 .80

#3 blcn .89 .85 .97

#4 btc .89 .80 .97

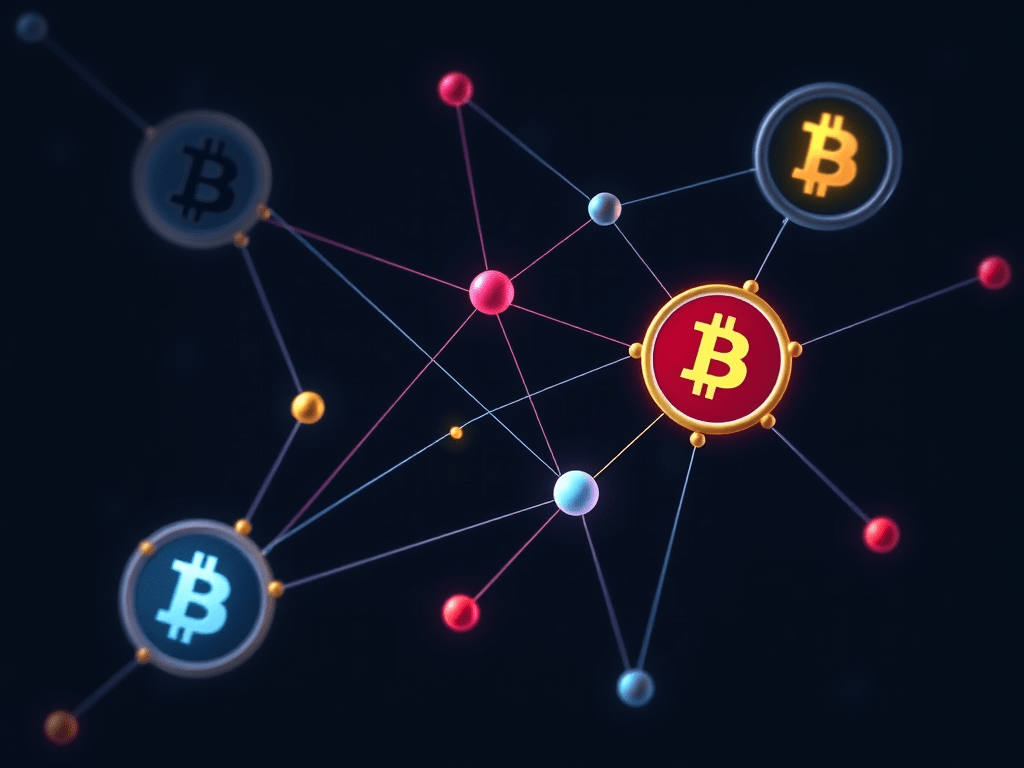

#Network plot

df_merged %>%

correlate() %>%

network_plot(min_cor = .7,

legend = "full")

The common perception appears to be correct based on the correlation analysis, specifically between the Nasdaq Blockchain Economy index and Bitcoin.

Leave a reply to Selcuk Disci Cancel reply