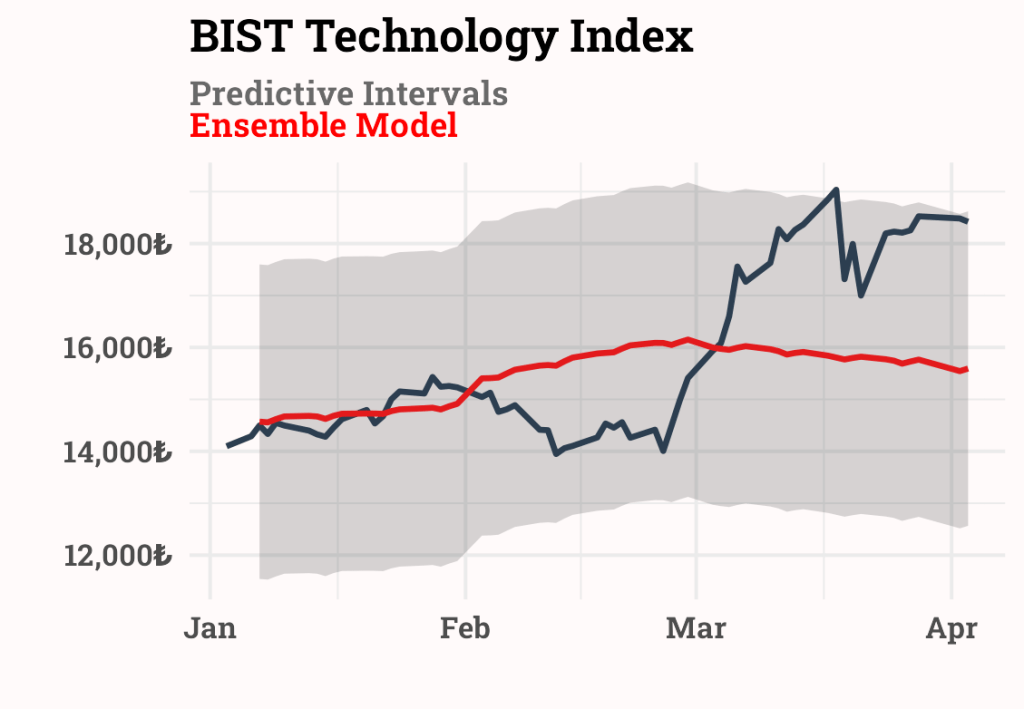

The BIST Technology index seems to have reached the upper band despite the ongoing political crisis in Turkey. But could it be continued?

Source code:

library(tidymodels)

library(tidyverse)

library(modeltime)

library(modeltime.ensemble)

library(timetk)

#BIST Technology Index

df_bist <-

read_csv("https://raw.githubusercontent.com/mesdi/investingcom/refs/heads/main/bist_tech.csv") %>%

janitor::clean_names() %>%

mutate(date = parse_date(date, "%m/%d/%Y")) %>%

select(date, value = price) %>%

slice_min(date, n = -1)

#Splitting

splits <-

time_series_split(df_bist,

assess = "3 months",

cumulative = TRUE)

#Recipe

recipe_spec <-

recipe(value ~ date, training(splits)) %>%

step_timeseries_signature(date) %>%

step_rm(matches("(.iso$)|(.xts$)")) %>%

step_normalize(matches("(index.num$)|(_year$)")) %>%

step_dummy(all_nominal()) %>%

step_fourier(date, K = 1, period = 365)

#Model 1 - Auto ARIMA

model_spec_arima <-

arima_reg() %>%

set_engine("auto_arima")

wflw_fit_arima <-

workflow() %>%

add_model(model_spec_arima) %>%

add_recipe(recipe_spec %>% step_rm(all_predictors(), -date)) %>%

fit(training(splits))

#Model 2 - Prophet

model_spec_prophet <-

prophet_reg() %>%

set_engine("prophet")

wflw_fit_prophet <-

workflow() %>%

add_model(model_spec_prophet) %>%

add_recipe(recipe_spec %>% step_rm(all_predictors(), -date)) %>%

fit(training(splits))

#Model 3 - Elastic Net

model_spec_glmnet <-

linear_reg(

mixture = 0.9,

penalty = 4.36e-6

) %>%

set_engine("glmnet")

wflw_fit_glmnet <-

workflow() %>%

add_model(model_spec_glmnet) %>%

add_recipe(recipe_spec %>% step_rm(date)) %>%

fit(training(splits))

#Modeltime Workflow for Ensemble Forecasting

df_models <-

modeltime_table(

wflw_fit_arima,

wflw_fit_prophet,

wflw_fit_glmnet

)

#Make an Ensemble

ensemble_fit <-

df_models %>%

ensemble_average(type = "mean")

#Calibration

calibration_tbl <-

modeltime_table(

ensemble_fit

) %>%

modeltime_calibrate(testing(splits))

#Accuracy

calibration_tbl %>%

modeltime_accuracy() %>%

table_modeltime_accuracy(

.interactive = FALSE

)

#Predictive intervals (95% Confidence Interval)

calibration_tbl %>%

modeltime_forecast(actual_data = df_bist %>%

filter(date >= last(date) - months(3)),

new_data = testing(splits)) %>%

plot_modeltime_forecast(.interactive = FALSE,

.legend_show = FALSE,

.line_size = 1.5,

.color_lab = "",

.title = "BIST Technology Index") +

labs(subtitle = "<span style = 'color:dimgrey;'>Predictive Intervals</span><br><span style = 'color:red;'>Ensemble Model</span>") +

scale_y_continuous(labels = scales::label_currency(prefix = "",suffix = "₺")) +

theme_minimal(base_family = "Roboto Slab", base_size = 20) +

theme(legend.position = "none",

plot.background = element_rect(fill = "azure",

color = "azure"),

plot.title = element_text(face = "bold"),

axis.text = element_text(face = "bold"),

#axis.text.x = element_text(angle = 60, hjust = 1, vjust = 1),

plot.subtitle = ggtext::element_markdown(face = "bold", size = 20))

Leave a comment