Bank of America cautioned that the Federal Reserve risks making a policy error if it starts cutting rates next month.

They indicated that economic activity has increased after a slowdown in the first half of the year, and if that is accurate, the labor market is likely to recover as well.

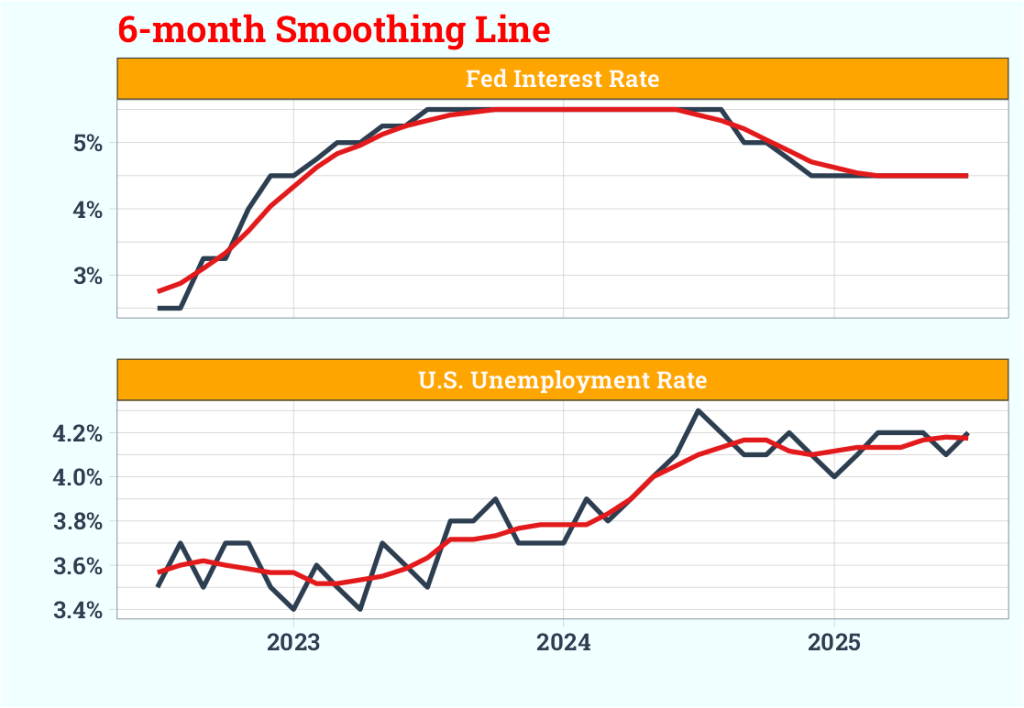

The rolling mean chart shows rate cuts came after the significant uptrend of unemployment, and we can not see such a that increasing recently.

Source code:

library(tidyverse)

library(timetk)

#U.S. Unemployment Rate

df_unemployment <-

read.delim("https://raw.githubusercontent.com/mesdi/blog/refs/heads/main/unemployment") %>%

as_tibble() %>%

janitor::clean_names() %>%

#removing parentheses and the text within

mutate(release_date = str_remove(release_date, " \\(.*\\)"),

actual = str_remove(actual, "%")) %>%

mutate(release_date = parse_date(release_date, "%b %d, %Y")) %>%

mutate(release_date = floor_date(release_date, "month") %m-% months(1),

actual = as.numeric(actual)) %>%

select(date = release_date, 'U.S. Unemployment Rate' = actual) %>%

drop_na()

#Fed Interest Rate

df_fed_rates <-

read.delim("https://raw.githubusercontent.com/mesdi/blog/refs/heads/main/fed_rates.txt") %>%

as_tibble() %>%

janitor::clean_names() %>%

#removing parentheses and the text within

mutate(release_date = str_remove(release_date, " \\(.*\\)"),

actual = str_remove(actual, "%")) %>%

mutate(release_date = parse_date(release_date, "%b %d, %Y")) %>%

mutate(release_date = floor_date(release_date, "month"),

actual = as.numeric(actual)) %>%

select(date = release_date, 'Fed Interest Rate' = actual) %>%

#makes regular time series by filling the time gaps

pad_by_time(date, .by = "month") %>%

fill('Fed Interest Rate', .direction = "down") %>%

drop_na()

#Survey data

df_survey <-

df_unemployment %>%

left_join(df_fed_rates) %>%

drop_na() %>%

pivot_longer(2:3,

names_to = "symbol",

values_to = "value")

#Sliding (Rolling) Calculations

# Make the rolling function

roll_avg_6 <-

slidify(.f = mean,

.period = 6,

.align = "center",

.partial = TRUE)

# Apply the rolling function

df_survey %>%

select(symbol,

date,

value) %>%

group_by(symbol) %>%

# Apply Sliding Function

mutate(rolling_avg_6 = roll_avg_6(value)) %>%

tidyr::pivot_longer(cols = c(value, rolling_avg_6)) %>%

plot_time_series(date,

value/100,

.color_var = name,

.line_size = 1.2,

.facet_ncol = 1,

.smooth = FALSE,

.interactive = FALSE) +

labs(title = "<span style = 'color:red;'>6-month Smoothing Line</span>",

y = "",

x = "") +

scale_y_continuous(labels = scales::percent_format()) +

theme_tq(base_family = "Roboto Slab", base_size = 16) +

theme(plot.title = ggtext::element_markdown(face = "bold"),

plot.background = element_rect(fill = "azure"),

strip.text = element_text(face = "bold", color = "snow"),

strip.background = element_rect(fill = "orange"),

axis.text = element_text(face = "bold"),

legend.position = "none")

Leave a comment